does doordash send w2

This form is essentially a W-2 for independent contractors. Payable may send you a 1099-K rather than a 1099-NEC if you are a full-time dasher.

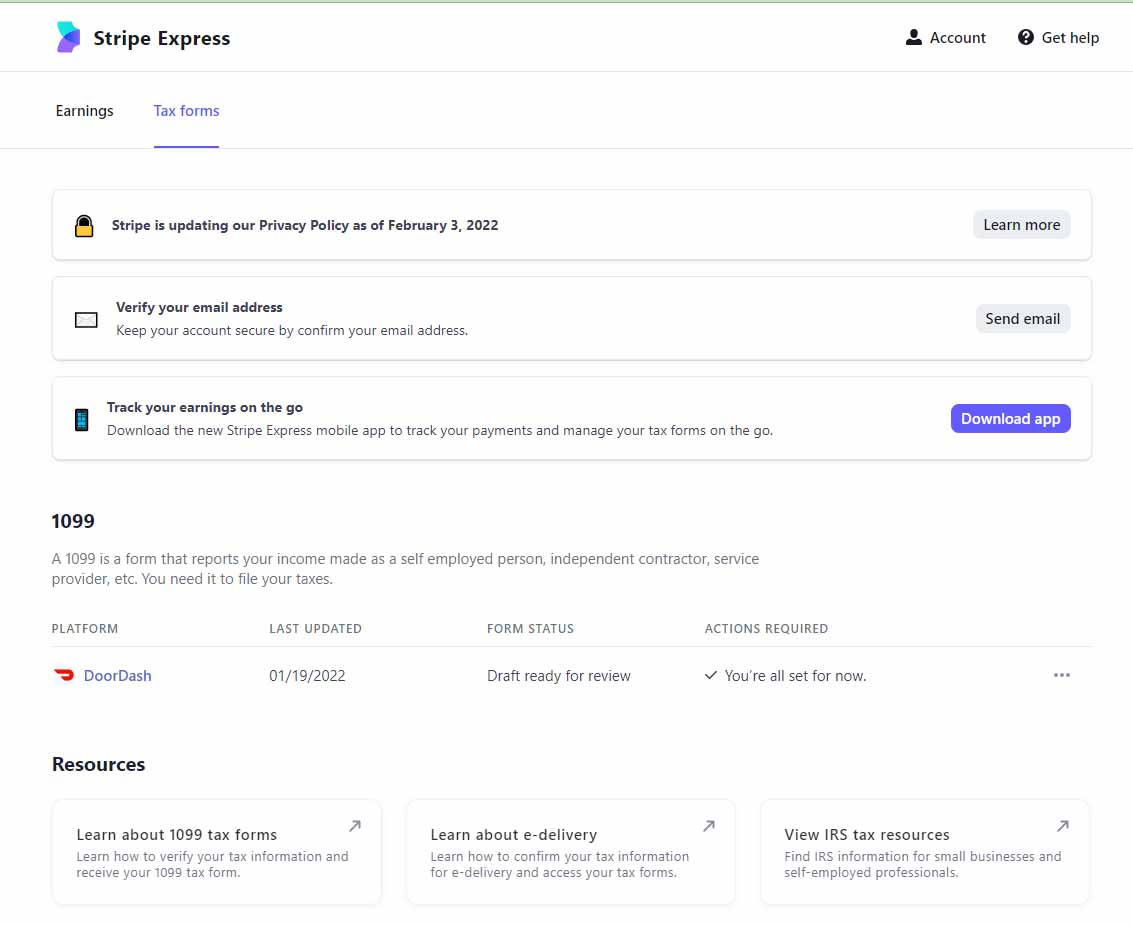

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Since DoorDash does not withhold your taxable income for you no matter the amount you make you have to report the amount to the IRS.

. Doordash will send you a 1099-NEC form to report income you made working with the company. The default answer is yes because you asked about reporting. If you earned 600 or more you should have received an email invitation in early january the subject of the email is confirm your tax information with doordash from stripe to.

But there are some. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. Restaurants Are Still Operating So Have Your Meal Delivered Safely and Securely.

Getting Your 1099 From DoorDash. By mail Does doordash send the W-2 are whatever tax papers to your home address are do they email it I moved and I dont know for sure how to change my address with doordash. The 1099 form is meant for the self-employed but it also can be used to report government payments interest dividends and more.

Typically you will receive your 1099 form before January 31 2022. Answer 1 of 5. The 1099-NEC short for Non-Employee.

Your employer has an obligation to send. Payable will send you the 1099-K because they handle the transactions related to your. Ad From National Restaurants to Local Mom Pops DoorDash Delivers the top Restaurants.

Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. The form youll use to file taxes will not be a W-2 but a 1099. Ad From National Restaurants to Local Mom Pops DoorDash Delivers the top Restaurants.

All Dashers who earn 600 or more within a calendar year will receive a 1099-NEC via Doordashs partnership with Stripe. This is the reported income a Dasher will use to. Restaurants Are Still Operating So Have Your Meal Delivered Safely and Securely.

The bottom line is your tax situation is unique. Paper Copy through Mail - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. I have a 1099 form from doordash which was electric mail this is my first time filling a 1099 w2 I dont know what Im doing need help That is self employment income.

For a normal job as an employee you would get a W2 and your employer would be paying your estimated tax due each paycheck according to how you filled out your W4. It may take 2-3 weeks for your tax documents to arrive by mail. Why Does This Doordash Tax Calculator Measure Tax Impact.

If however you made more than 20000 working for DoorDash and have more than 200 transactions with them you. All DoorDash contractors will receive an email from Payable a third party company hired by the company to handle distribution of their tax documents. If you are completing a tax return everything is supposed to be reported.

Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. You may be wondering what exact.

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

How To Do Taxes For Doordash Drivers 2020 Youtube

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

8 Essential Things You Should Know About Doordash 1099

How Does Doordash Do Taxes Taxestalk Net

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Form 1099 Nec For Nonemployee Compensation H R Block

Does Doordash Send You A W2 Yes If You Are Doordash Employee

Does Doordash Send You A W2 In 2022 Try This Instead

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

How To Get Doordash Tax 1099 Forms Youtube

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com